Roth Vs Traditional 401 K Calculator

Roth Vs Traditional 401 K Calculator - Use these free retirement calculators to determine how. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): For the traditional 401 (k), this is the sum of two parts: Web most ira contributions go into this kind of account. Web roth 401 (k) vs traditional 401 (k) calculator.

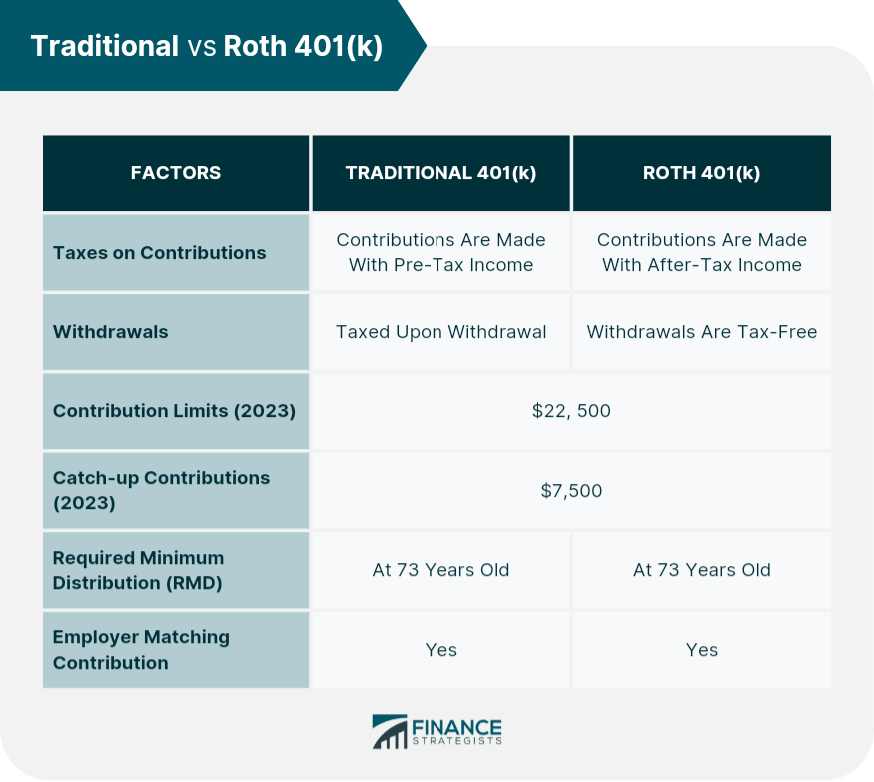

Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web roth 401 (k) vs. For the traditional 401 (k), this is the sum of two parts: Web roth 401 (k) vs traditional 401 (k) calculator find out which kind of 401 (k) is best for you updated february, 2024 roth vs. (csia) is an affiliate of charles schwab & co., inc. Money you withdraw from a roth 401 (k) will not be taxed. Web roth vs traditional 401 (k) calculator roth 401 (k) contributions are a relatively new type of 401 (k) that allows you to invest money after taxes, and pay no taxes when funds are.

IRA vs 401(k) and Roth vs traditional Personal Finance Club

Web money you withdraw from a traditional 401 (k) will be taxed as ordinary income. Web charles schwab investment advisory, inc. For the traditional 401 (k), this is the sum of two parts: 1) the.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Under the same assumptions, maxing out the 401k option will leave you over $3.5m. Web traditional 401k or roth ira calculator traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a.

Roth 401(k) Vs. Traditional 401(k) And What Is The Best Option

Current age (1 to 120) your annual. Access to advisorsadvice & guidance A 401 (k) contribution can be an effective retirement tool. Web high yield $10,000 mma. Schwab etfs are distributed by sei investments.

Roth 401(k) vs. Traditional 401(k)

Web here are some of the key differences: Web roth 401 (k) vs. A 401 (k) contribution can be an effective retirement tool. Web high yield $10,000 mma. Traditional ira depends on your income level.

Traditional vs Roth 401(k) Key Differences and Choosing One

The roth 401 (k) allows you to contribute to your 401 (k) account on an. Current age (1 to 120) your annual. Web ira contribution limits for 2024. Web roth 401k is the same idea.

Roth 401k Might Make You Richer Millennial Money

Web money you withdraw from a traditional 401 (k) will be taxed as ordinary income. A 401 (k) contribution can be an effective retirement tool. Web roth 401k is the same idea except with the.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Schwab etfs are distributed by sei investments. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Web roth 401 (k) vs. Web roth 401 (k) $ 177,592..

401(k) vs. Roth 401(k) Which One Is Better?

Web money you withdraw from a traditional 401 (k) will be taxed as ordinary income. Traditional ira calculator choosing between a roth vs. Web most ira contributions go into this kind of account. Web traditional.

Traditional vs Roth 401(k) What You Need to Know

According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. The roth 401 (k) allows you to contribute to your 401 (k) account on an..

401(k) vs Roth 401(k) How Do You Decide? Ellevest

Web both roth and traditional 401 (k) contribution limits are currently set at $22,500 for 2023 ($30,000 if you’re over the age of 50), and $23,000 (30,500 if you’re. A 401 (k) contribution can be.

Roth Vs Traditional 401 K Calculator According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. A 401 (k) contribution can be an effective retirement tool. This tool compares the hypothetical. Web here are some of the key differences: Money you withdraw from a roth 401 (k) will not be taxed.

.jpg)