Partial 1031 Calculator

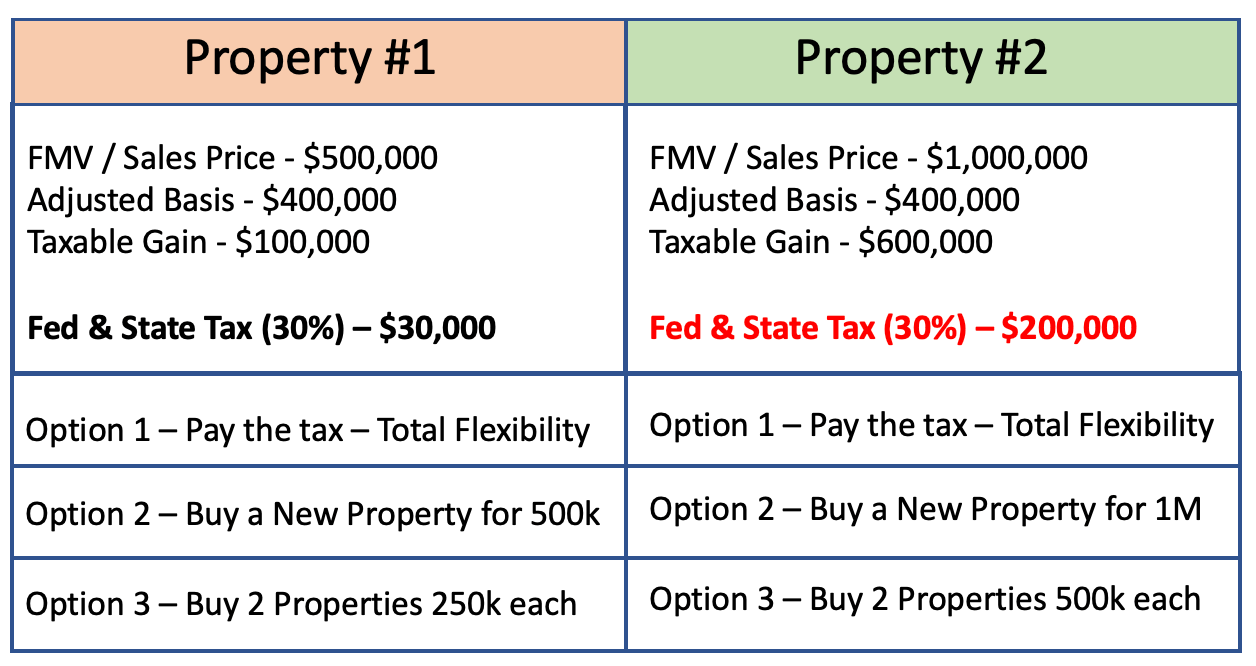

Partial 1031 Calculator - This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. This simplified estimator is for. Web by doing a partial 1031 you can use some of your proceeds for reinvesting while pulling out taxable cash for other uses. You can use the $400,000 from the sale and take out a mortgage for $600,000, satisfying the 1031 exchange. The taxes deferred on the relinquished property (investment property sold) allow for greater net sales proceeds to.

Web even though taxes are being deferred, 1031 exchanges must be reported to the irs. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. | how to avoid boot | partial 1031 exchange boot faqs. This tax strategy allows you to exchange a portion of your sales proceeds and. Web custom partial 1031 exchange boot calculator calculator, built using calconic_ Web partial 1031 exchange boot calculator. Gainbridge.io has been visited by 10k+ users in the past month

1031 Exchange When Selling a Business

The taxes deferred on the relinquished property (investment property sold) allow for greater net sales proceeds to. Web custom partial 1031 exchange boot calculator calculator, built using calconic_ The exchange must be reported in the.

Partial 1031 Exchange Complete Guide (2022)

Web published june 21, 2023. To pay no tax when executing a 1031 exchange, you must purchase at least. Web by evaluating all options according to how they align with your objectives, the partial 1031.

How To Do A 1031 Exchange Like A Pro Free Guide

The taxes deferred on the relinquished property (investment property sold) allow for greater net sales proceeds to. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a.

How to Complete a Partial 1031 Exchange The 1031 Investor

This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work.

When and How to use the 1031 Exchange Mark J. Kohler

Web by doing a partial 1031 you can use some of your proceeds for reinvesting while pulling out taxable cash for other uses. Web you can do a partial 1031 exchange, which is also known.

Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator

To do this, the exchanger must. To pay no tax when executing a 1031 exchange, you must purchase at least. Strategies to achieve 100% tax deferral. Note that you can see all of the calculations.

Partial 1031 Exchange An Investor's Guide FNRP

What is a partial 1031 exchange?. You can use the $400,000 from the sale and take out a mortgage for $600,000, satisfying the 1031 exchange. Web this 1031 exchange calculator will estimate the taxable impact.

Partial 1031 Exchange [Explained AtoZ] PropertyCashin

The taxes deferred on the relinquished property (investment property sold) allow for greater net sales proceeds to. Web partial 1031 exchange boot calculator. Web by doing a partial 1031 you can use some of your.

Partial 1031 Exchanges, where the taxpayer has a partially deferred

Web compare net sales proceeds available for reinvestment. Web you have your eye on a replacement property for $1 million. A 1031 exchange allows a taxpayer to defer 100% of their capital gain tax liability..

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Web you have your eye on a replacement property for $1 million. To pay no tax when executing a 1031 exchange, you must purchase at least. To do this, the exchanger must. Web this capital.

Partial 1031 Calculator Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 exchange). Gainbridge.io has been visited by 10k+ users in the past month To pay no tax when executing a 1031 exchange,. Web the answer is yes. Web even though taxes are being deferred, 1031 exchanges must be reported to the irs.

![Partial 1031 Exchange [Explained AtoZ] PropertyCashin](https://i2.wp.com/propertycashin.com/wp-content/uploads/2020/11/Partial-1031-Exchange-Explained.png)