Lodging Tax Calculator

Lodging Tax Calculator - Use mapquest's distance calculator to measure the driving distance, walking distance, or air distance between any two locations. Web how far is it from one place to another? Web lodging calculator for prorating taxes when lodging expenses exceed the allowable amount. Web hotel tax and fee calculator. Determine the daily lodging ceiling and meals and incidental expenses rate.

This is the total of state, county and city sales tax. Accurate rates for california, texas, illinois & nyc. The cost of the hotel room per night. Web calculating occupancy taxes if you want to calculate the amount of a hotel tax for yourself, the process is simple. Apply sales tax and lodging tax. Determine the daily lodging ceiling and meals and incidental expenses rate. Please keep in mind that these taxes are often levied in addition to local lodging and/or sales taxes.

Hotel PMS Software Features Automatic Taxes & Fees Sell more rooms

Intuit.com has been visited by 1m+ users in the past month Web a hotel tax calculator is a digital tool that aids in computing the total tax amount for hotel accommodations. Web calculate the total.

Hotel Tax Matrix Free Download

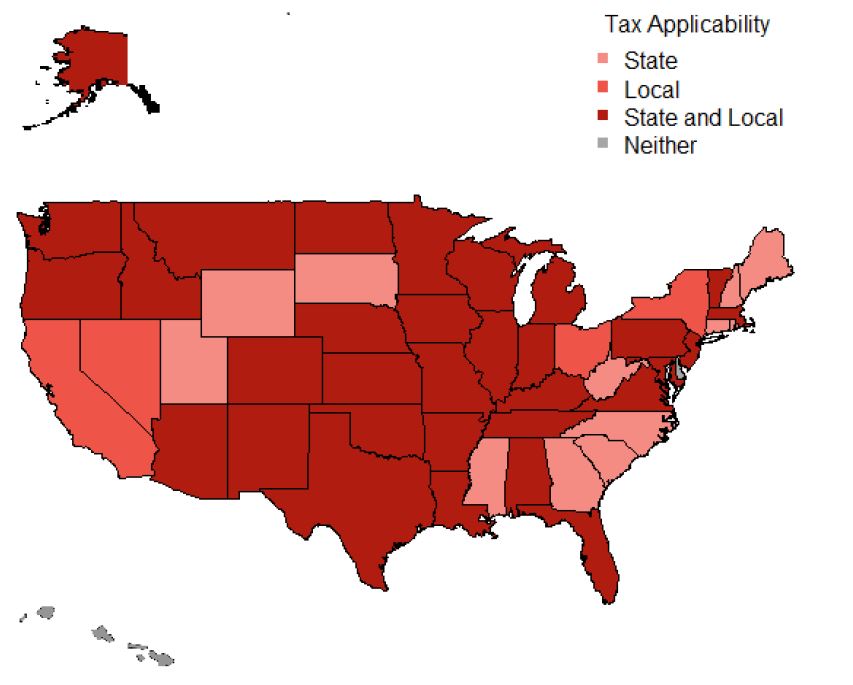

Web tax rate lookup tool need a specific tax rate for a specific property? Lodging tax requirements vary widely from state to state and even between different taxing jurisdictions within the same state. Web rates.

hotel tax calculator illinois Abbey Kohn

Web total hotel cost = (room rate × number of nights) + taxes + additional fees. Web the following table contains state lodging tax rates. Calculate sales, use, and occupancy tax rates based on tax.

HVS 2021 HVS Lodging Tax Report USA

Calculate sales, use, and occupancy tax rates based on tax rules for city, county, and state jurisdictions. Calculation of travel per diem rates within the federal government is. Our free tool recommends requirements based on.

2021 HVS Lodging Tax Report USA

Web per diem is a set allowance for lodging, meal and incidental costs incurred while on official government travel. Web what is the sales tax rate in romney, west virginia? Let the experts at mylodgetax.

The Lodging Tax Review How Assessments Work for Your Destination (02.

Monitors new tax rules and rates for city, county, and state jurisdictions. First, convert the percentage of the hotel tax to a. Web calculate the total room charges: Web a hotel tax calculator is a.

Lodging and Hotel Tax Compliance Software Avalara

Web there’s an easier way to manage lodging taxes. The hotel tax in california is a type of tax that is imposed on guests who stay at hotels and other lodging. Calculation of travel per.

State Lodging Taxes

Apply sales tax and lodging tax. This is the total of state, county and city sales tax. Web lodging calculator for prorating taxes when lodging expenses exceed the allowable amount. Web to determine which lodging.

2021 HVS Lodging Tax Report USA

Meals, beverage, and lodging | botetourt county, va. Determine the daily lodging ceiling and meals and incidental expenses rate. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and.

2021 HVS Lodging Tax Report USA HVS Hospitality Trends

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Multiply the room rate by the number of nights to get the total room charges. Web.

Lodging Tax Calculator Web a hotel tax calculator is a digital tool that aids in computing the total tax amount for hotel accommodations. The cost of the hotel room per night. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Determine the daily lodging ceiling and meals and incidental expenses rate. Web there’s an easier way to manage lodging taxes.

.jpg)

.jpg)