How To Calculate 1031 Exchange Basis

How To Calculate 1031 Exchange Basis - Web of $900,000 and the taxpayer adds cash of $100,000. The taxpayer sells the property for. Web capital gains calculator realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and. Liabilities assumed by taxpayer +. 1031 exchange, the tax basis calculations can vary significantly depending on the circumstances.

Web calculate the realized amount and new property basis. Web to calculate the 1031 exchange basis, you first need to determine the adjusted basis of the property you are relinquishing. To pay no tax when executing a 1031 exchange, you must purchase at. Amazon.com has been visited by 1m+ users in the past month Web to calculate your tax basis for a 1031 exchange, you need to identify any adjustments and additions made to the original cost of your property. Web capital gains calculator realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Amazon.com has been visited by 1m+ users in the past month To pay no tax when executing a 1031.

1031 Exchange The Accounting Mosaic

The simplest type of section 1031 exchange is a simultaneous swap of one property for. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes.

The Complete 1031 Exchange Guide White Cloud Wealth Management

A taxpayer prepares to sell residential property a, which they’ve owned for 10 years, and which has an adjusted basis of $225,000. Web to accomplish a section 1031 exchange, there must be an exchange of.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Web to calculate the 1031 exchange basis, you first need to determine the adjusted basis of the property you are relinquishing. A taxpayer prepares to sell residential property a, which they’ve owned for 10 years,.

The Complete Guide to 1031 Exchange Rules

The taxpayer sells the property for. Web of $900,000 and the taxpayer adds cash of $100,000. Web how cost basis changes after a 1031 exchange. A taxpayer prepares to sell residential property a, which they’ve.

1031 Exchange Full Guide Casaplorer

Calculate capital gain tax due. Web even though taxes are being deferred, 1031 exchanges must be reported to the irs. Figure out the adjusted basis in the property that you have just sold. Liabilities assumed.

What is a 1031 Exchange?

Web of $900,000 and the taxpayer adds cash of $100,000. Web capital gains calculator realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property.

How To Do A 1031 Exchange Like A Pro Free Guide

The new cost basis that is used to determine the amount you can depreciate after you complete a 1031 exchange is. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale.

1031 Exchange Capital Gain Calculations Calculating Equity

1031 exchanges don’t work to downsize an investment. To get a rough estimate of your basis, follow these steps: The term—which gets its name. If the purchase price of the replacement property is less. Submit.

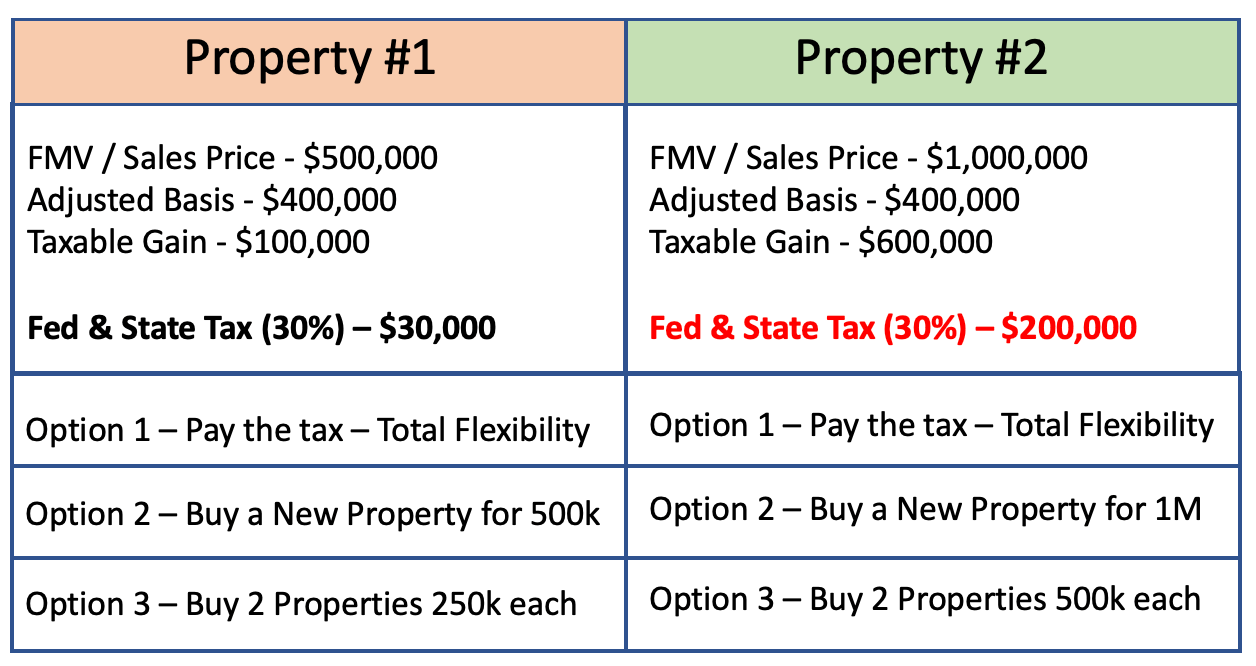

When and How to use the 1031 Exchange Mark J. Kohler

The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Web below are the steps to explain how to calculate the cost basis of your new property. Basis of.

How To Calculate 1031 Exchange Basis Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Web to accomplish a section 1031 exchange, there must be an exchange of properties. Web below are the steps to explain how to calculate the cost basis of your new property. It allows you to defer.