Dallas Property Tax Calculator

Dallas Property Tax Calculator - Market value county and school equalization 2024 est. Web you can use the property tax estimator provided by the dallas county appraisal district to estimate your property tax for the year 2024. Dallas central appraisal district (dcad) is responsible for appraising property for the purpose of ad valorem property tax. It's important to note that this rate is specific to the city of. Web online property tax estimator.

Web estimate my dallas county property tax. In harris county, where houston is located, the average effective property tax rate is 1.91%. If you know the amount of transfer tax paid, and want to determine. Though not supported by dallascad, it will calculate taxes for a city, a. Web property tax calculator to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Market value county and school equalization 2024 est. Web go to www.dallascounty.org/tax, click on property tax lookup/payment application on the property tax dropdown, scroll down and click search for your property here.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

Web property tax calculator to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. In harris county, where houston is located, the.

Property Tax Calculator

Web property tax calculator to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Market value county and school equalization 2024 est..

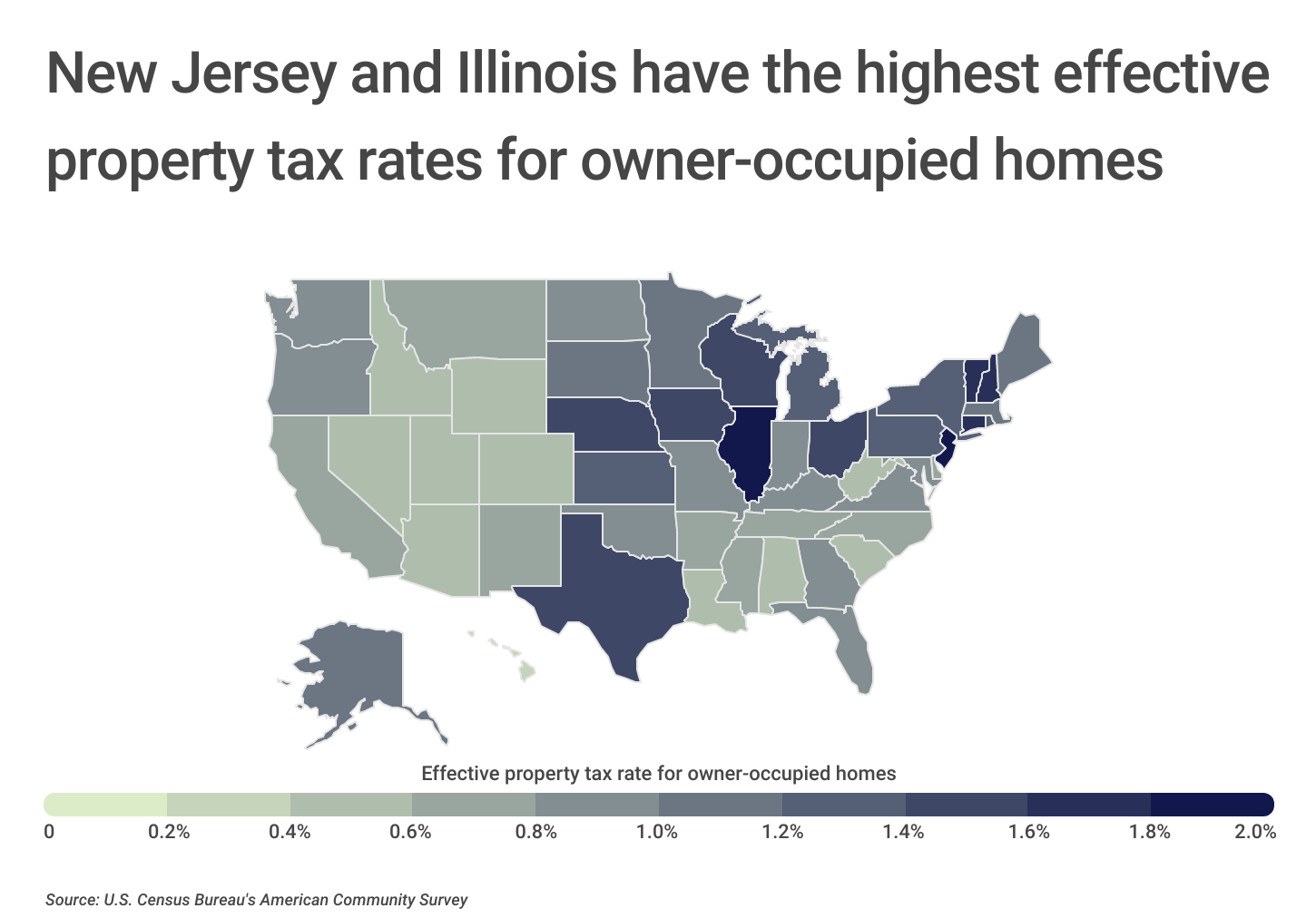

A Breakdown of 2021 Property Tax by State

Web online property tax estimator. Web pay a property tax bill. Dallas central appraisal district (dcad) is responsible for appraising property for the purpose of ad valorem property tax. Though not supported by dallascad, it.

DallasFort Worth Property Tax Rates

Our texas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. Web welcome to the dallas county tax office. Dallas county collects, on average,.

American Cities With the Highest Property Taxes [2023 Edition

The tax assessment value may differ from the potential sale value,. Web online property tax estimator. Web welcome to the dallas county tax office. Dallas county collects, on average, 2.18% of a property's. Market value.

Property Taxes in Dallas Suburbs 8 Cities With Low Rates

Calculator is designed for simple accounts. English (united states) español (estados unidos) Contact dcad with any questions. Web the average property tax rate in dallas county is 1.96%, higher than the state average of 1.69%..

Dallas Property Tax Dallas Home Prices

Ad valorem tax rates for dallas county. List of tax collecting agencies. Web property tax estimator note: Web tax calculator enter amount paid in the box below exclude commas (,) and dollar signs ($), then.

How to Calculate Property Taxes

Dallas county municipal utility district no. Homes sold by zipcodesell your house fastfind local home valuesrecently sold homes Web 7:30 a.m to 5:00 p.m. Market value county and school equalization 2024 est. Our texas property.

Dallas Texas Property Tax How to Lower Your DFW Taxes

Web in dallas county, for example, the average effective rate is 1.81%. In harris county, where houston is located, the average effective property tax rate is 1.91%. Web you can use the property tax estimator.

Property Tax Dallas 2023

Web estimate my texas property tax. Dallas county collects, on average, 2.18% of a property's. Taxes are due upon receipt, and delinquent if paid a er. Web 7:30 a.m to 5:00 p.m. Though not supported.

Dallas Property Tax Calculator Web estimate my dallas county property tax. Dallas county collects, on average, 2.18% of a property's. Web the average property tax rate in dallas county is 1.96%, higher than the state average of 1.69%. Web 7:30 a.m to 5:00 p.m. Web in dallas county, for example, the average effective rate is 1.81%.